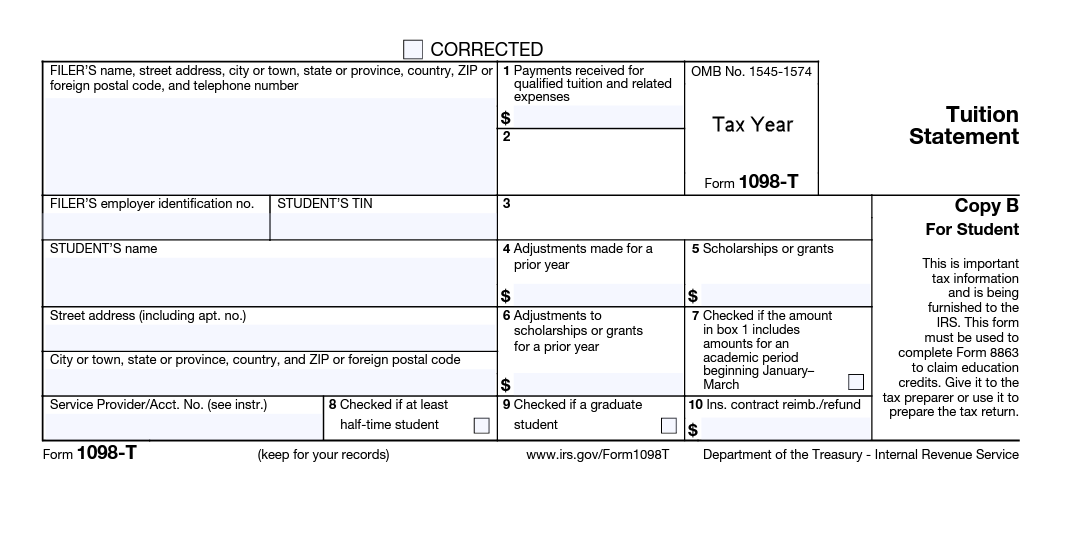

What Information Appears on Your 1098-T Tax Form?

The 1098-T tax form is subdivided into 10 boxes. The university may leave some of these boxes blank if they do not apply to you.

- Box 1: Payments Received for Qualified Tuition and Related Expenses

- Box 2: Amounts Billed for Qualified Tuition and Related Expenses - This box is left blank.

- Box 3: Checkbox for Change of Reporting Method – This box is left blank.

- Box 4: Adjustments Made for a Prior Year – This box will only have an amount if there were any adjustments in payments for qualified tuition and related expenses from the previous tax years.

- Box 5: Scholarships or Grants – This box will only have an amount if you have a Pell Grant payment, outside scholarship, military benefits, or employer-provided assistance administered by the university.

- Box 6: Adjustments to Scholarships or Grants for a Prior Year – This box will only have an amount if there were any adjustments to scholarship or grant amounts from previous tax years.

- Box 7: Amounts for an Academic Period Beginning in January through March of the following tax year

- Box 8: Check if at Least Half-Time Student – This box may be checked if you have at least 6 undergraduate or 3 graduate credits per 16-week semester.

- Box 9: Check if a Graduate Student – This box may be checked if you’re pursuing a graduate degree program or certificate.

- Box 10: Insurance Contract Reimbursements or Refunds – This box is left blank.

Below is an image of a typical 1098-T tax form that you’ll receive from the university.

If you have additional questions about this tax form, please email [email protected] or call 877-755-2787 during the following hours:

Mon - Thurs: 8 a.m. to 8 p.m. ET

Fri: 8 a.m. to 4:30 p.m. ET

Sat: 11 a.m. to 3 p.m. ET

Sun: Closed